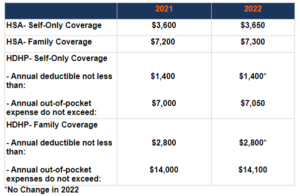

These are three important advantages that far outweigh the advantages of many other tax accounts. Gains from investments in the account are never taxed, as long as it is used for qualifying medical expenses. Withdrawals used for eligible medical expenses are never taxable The contribution is a deferred tax, which means that it is deducted as an adjustment on the first page of the account holder's income tax return and is not subject to income tax until withdrawal. These limits apply to the network costs for the plan there are no specific limits set for out-of-network coverage and costs.Ĭontributions to the HSA have tax advantages on three levels: For 2022, the minimum out-of-pocket expenses allowed is $7,050 for singles and $14,100 for family coverage. For 2022, the minimums remain the same.įor the year 2021, the maximum eligible direct expenses of the plan will increase to $7,000 for singles and $14,000 for family coverage. Highly deductible health plans offer lower premiums than traditional health insurance plans, with much higher deductibles being offset (the amount the insured must pay before the insurer begins to cover some or all of the total cost of the medical treatment or physician) compared to traditional health insurance plans.įor 2021, the minimum deduction for the health plan remains the same, at $1,400 for individuals and $2,800 for joint filers.

#Hsa eligible expenses 2021 full

The account holder is the full owner of all contributions, even if made by an employer and can invest the funds in various investment options offered by the financial custodian, which will typically be a variety of mutual funds or index funds. The funds in these accounts are similar to any normal investment account. Health Savings Accounts (HSAs) are individual savings accounts with tax benefits designed specifically to pay the medical bills of people enrolled in High Deductible Health Plans (HDHP).Īs long as HSA funds are used to pay qualifying medical bills, account holders will not pay tax on the amount withdrawn.

Continue through the HSA screens, making sure you answered all questions correctly.On that screen, make sure you didn't accidentally re-enter the amount already listed (from box 12 of your W-2) as this will incorrectly double your total contribution amount.Step through the interview until you reach Let's enter your HSA contributions.With your return open, search for hsa inside your program and then select the Jump to link to open the HSA summary screen.We recommend revisiting the HSA entry screens to make sure the excess contribution wasn't due to an entry error. Spouses 55 or older at the end of 2021 are allowed to contribute an additional $1,000 to their own HSA. In this scenario, the couple may split their contributions any way they like, as long as the couple's total contribution doesn't exceed $7,200. Spouses on separate plans: The $7,200 family limit applies to married couples even if one spouse is covered by a family plan and the other spouse has their own individual plan.If you had HDHP coverage on December 1 (the last month of the year), then you can use the full annual HSA contribution limit for your HDHP coverage, regardless of the number of months you had coverage.

If you're covered by an HDHP on the first day of the month, you're considered covered for the entire month.If you were only covered by an HDHP for part of the year, your contribution limit may be lower than above limits.The above limits are prorated depending on the number of months you were covered by an HDHP and had no additional health coverage.If you overfunded or weren't eligible to contribute to your HSA in 2021, you'll need to withdraw the excess amount by Apto avoid a penalty (October 15 if you filed an extension).

$8,200 if you're 55 or older at the end of 2021 and are covered by a family HDHP.$4,600 if you're 55 or older at the end of 2021 and are covered by an individual (self-only) HDHP.

0 kommentar(er)

0 kommentar(er)